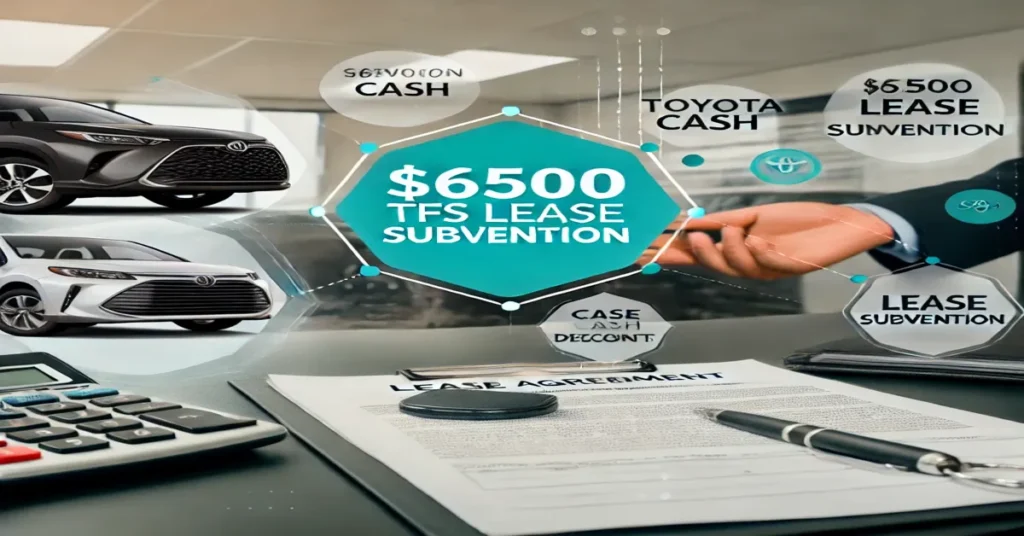

When it comes to purchasing or leasing a new vehicle, understanding the different incentives and financial options available can make a significant difference in your overall cost. One such incentive that can be particularly valuable to potential lessees is the concept of lease subvention cash, which helps lower the cost of leasing a vehicle by offering discounts or financial assistance. One of the most frequently encountered forms of this assistance is the “6500 TFS Lease Subvention Cash.”

In this comprehensive guide, we will explore what the 6500 TFS Lease Subvention Cash entails, how it benefits both car dealerships and customers, and how you can take full advantage of this offer. We’ll also examine how this type of financial incentive impacts the lease process, the overall car leasing landscape, and some common questions related to lease subvention programs.

By the end of this guide, you’ll have a complete understanding of the 6500 TFS Lease Subvention Cash and how it can work to your advantage when leasing your next vehicle.

1. What is Lease Subvention?

To fully appreciate the 6500 TFS Lease Subvention Cash, it is essential to first understand what “lease subvention” means. Lease subvention is essentially financial assistance provided by a third party (often the vehicle manufacturer or a related financial services provider) to reduce the cost of leasing a car. This incentive can come in the form of reduced interest rates, lowered lease payments, or lump-sum cash reductions, such as the 6500 TFS Lease Subvention Cash.

1.1. Purpose of Lease Subvention

The primary purpose of lease subvention is to make leasing a more attractive option for customers. By lowering the cost of leasing through discounted payments or cash incentives, manufacturers and dealerships can increase the number of leases and move more vehicles off their lots. This, in turn, helps them maintain or boost their market share.

1.2. How Lease Subvention Works

Lease subvention is typically applied during the negotiation process when a customer is choosing to lease a vehicle. The dealer may inform the customer of any available subvention programs, which can then be applied to reduce the cost of the lease. The customer does not usually receive the subvention amount directly; instead, it is factored into the lease payments, reducing the monthly cost or upfront expenses.

2. Understanding the 6500 TFS Lease Subvention Cash

The 6500 TFS Lease Subvention Cash is a specific form of lease subvention offered through Toyota Financial Services (TFS). It represents a $6,500 financial incentive that is applied to reduce the cost of leasing select Toyota models. This type of subvention cash is generally available for a limited time and may be part of promotional campaigns designed to boost sales during particular periods, such as the end of the fiscal year or holiday sales events.

2.1. Who Offers the 6500 TFS Lease Subvention Cash?

Toyota Financial Services (TFS) is the entity that provides this type of subvention cash. TFS is Toyota’s financial services arm and offers a wide range of auto financing solutions, including loans and leases. The subvention cash is typically applied when customers lease through TFS at authorized Toyota dealerships.

2.2. Eligible Vehicles

Not all vehicles are eligible for the 6500 TFS Lease Subvention Cash. The specific models that qualify for the offer may vary depending on the promotional period. Commonly, this type of subvention cash is available for higher-end or overstocked models. It’s important to check with a Toyota dealership to see which vehicles are eligible for this particular incentive.

2.3. Key Terms and Conditions

As with most financial incentives, there are certain terms and conditions that apply to the 6500 TFS Lease Subvention Cash. These may include:

- Eligibility: Only customers who lease through TFS are eligible for this incentive.

- Lease Terms: The subvention cash may only be applied to leases with specific terms (e.g., a 36-month lease).

- Limitations: The offer is generally available for a limited time, and it may be subject to approval based on the customer’s credit score.

3. Benefits of the 6500 TFS Lease Subvention Cash

There are several benefits to both the lessee and the dealership when it comes to the 6500 TFS Lease Subvention Cash. These benefits can make leasing an attractive option compared to purchasing a vehicle outright.

3.1. Reduced Monthly Lease Payments

The most immediate benefit of the 6500 TFS Lease Subvention Cash is a reduction in the monthly lease payments. With the $6,500 applied to the total lease cost, customers can enjoy lower payments throughout the term of the lease, making it easier to budget for the vehicle.

3.2. Lower Upfront Costs

In addition to lowering monthly payments, lease subvention cash can also reduce the upfront cost of leasing. The 6500 TFS Lease Subvention Cash may be applied to offset down payments, security deposits, or other upfront fees, making it more affordable for customers to drive off the lot in a new vehicle.

3.3. Flexible Lease Options

Because the 6500 TFS Lease Subvention Cash reduces overall lease costs, it can give customers more flexibility when choosing a vehicle. For example, a customer may be able to lease a higher-end model or add more optional features (such as navigation or upgraded sound systems) that might have been out of reach without the incentive.

3.4. Increased Access to New Models

By applying lease subvention cash, Toyota is able to increase customer access to newer vehicle models. Instead of waiting for a lower-priced used vehicle or a more affordable lease option, customers can lease new Toyota models with the financial assistance provided by the subvention cash.

4. How the 6500 TFS Lease Subvention Cash Impacts Leasing

The 6500 TFS Lease Subvention Cash is a game-changer for customers considering leasing a vehicle. It can significantly impact the overall cost of the lease, influencing everything from the monthly payments to the total out-of-pocket expenses. Below are some key ways in which this subvention cash affects the leasing process.

4.1. Impact on Lease Residual Value

Lease subvention cash does not directly affect the residual value of the vehicle, which is the amount the vehicle is worth at the end of the lease. However, because the 6500 TFS Lease Subvention Cash reduces the lease payments, customers may feel more comfortable with the vehicle’s depreciation over the course of the lease.

4.2. Impact on Money Factor

In leasing, the “money factor” represents the interest rate on the lease. While lease subvention cash does not directly lower the money factor, it does reduce the capitalized cost of the lease, which is the amount on which the interest is calculated. As a result, the total interest paid over the life of the lease is lower, making the lease more affordable.

4.3. Shorter Lease Terms

In some cases, the 6500 TFS Lease Subvention Cash may allow customers to opt for shorter lease terms. For example, customers who may have only been able to afford a 48-month lease without the subvention cash may now be able to choose a 36-month lease with lower payments, thanks to the financial incentive.

5. Leasing vs. Buying with Subvention Cash

For customers considering leasing or buying a new Toyota vehicle, the availability of subvention cash can tip the scales in favor of leasing. Here’s how leasing compares to buying when subvention cash is factored in:

5.1. Cost Efficiency

Leasing is generally more cost-efficient in the short term, as monthly payments are typically lower than loan payments for purchasing a car. When subvention cash is added into the equation, the cost of leasing becomes even more attractive. In contrast, while buyers may receive cash rebates when purchasing a car, these are usually smaller than lease subvention cash offers like the 6500 TFS Lease Subvention Cash.

5.2. Depreciation

When leasing a vehicle, depreciation is less of a concern because the lessee does not own the car at the end of the lease term. Subvention cash further reduces the lessee’s financial burden, making leasing an appealing option for those who do not want to deal with the depreciation of the vehicle’s value. Buyers, on the other hand, must deal with the depreciation of their vehicle, especially in the early years of ownership.

5.3. Flexibility

Leasing offers more flexibility than buying, as customers can choose to lease a new vehicle every few years. With subvention cash like the 6500 TFS Lease Subvention Cash, lessees can access new models at a lower cost, making it easier to stay up to date with the latest vehicle features and technologies.

6. How to Qualify for the 6500 TFS Lease Subvention Cash

Qualifying for the 6500 TFS Lease Subvention Cash generally requires the following:

6.1. Leasing Through TFS

Customers must lease their vehicle through Toyota Financial Services to qualify for the subvention cash. This means working with an authorized Toyota dealership and signing a lease agreement through TFS.

6.2. Good Credit Score

A good credit score is typically required to qualify for the best lease terms, including subvention cash offers. While each dealership may have different requirements, customers with a credit score of 700 or higher are more likely to qualify for the 6500 TFS Lease Subvention Cash.

6.3. Lease Term Length

The subvention cash may only be available for leases of a specific term length. Common lease term lengths include 36 or 48 months, but it is important to confirm with your dealership which terms qualify for the incentive.

6.4. Promotional Period

The 6500 TFS Lease Subvention Cash is typically available during specific promotional periods. These promotions may occur during sales events such as year-end clearance sales, holiday promotions, or special manufacturer-driven incentives. Be sure to check with your local Toyota dealership for the availability of this offer.

7. Taking Full Advantage of Lease Subvention Cash

To maximize the benefits of the 6500 TFS Lease Subvention Cash, customers should take the following steps:

7.1. Shop During Promotional Periods

Subvention cash offers like the 6500 TFS Lease Subvention Cash are often tied to specific promotional events. Keep an eye out for these events and plan to lease your vehicle when the offer is available. Timing your lease correctly can save you thousands of dollars.

7.2. Negotiate Other Lease Terms

Even with subvention cash applied, there is still room for negotiation in your lease terms. You may be able to negotiate a lower money factor, reduced fees, or additional incentives such as free maintenance or extended warranties.

7.3. Lease a Higher-End Model

With the financial relief provided by the 6500 TFS Lease Subvention Cash, you may be able to afford a higher-end model or add extra features to your lease package. This allows you to enjoy more luxury, safety, or technology features without breaking the bank.

Conclusion

The 6500 TFS Lease Subvention Cash is a powerful tool for customers looking to lease a new Toyota vehicle at a reduced cost. By understanding how lease subvention works and how the 6500 TFS incentive can lower your overall lease payments, you can make a more informed decision when selecting a vehicle and signing a lease. Whether you’re interested in driving the latest Toyota model or reducing your monthly lease payments, the 6500 TFS Lease Subvention Cash can provide significant financial benefits.

FAQs

1. What is the 6500 TFS Lease Subvention Cash?

The 6500 TFS Lease Subvention Cash is a $6,500 financial incentive provided by Toyota Financial Services to reduce the cost of leasing select Toyota vehicles.

2. How can I qualify for the 6500 TFS Lease Subvention Cash?

To qualify, you must lease through Toyota Financial Services, have a good credit score, and lease during a promotional period.

3. Can the 6500 TFS Lease Subvention Cash be used on all Toyota vehicles?

No, the incentive is typically available only on select Toyota models, and eligibility may vary by promotional period.

4. How does the 6500 TFS Lease Subvention Cash affect my monthly payments?

The subvention cash reduces the capitalized cost of the lease, resulting in lower monthly payments.

5. Does the 6500 TFS Lease Subvention Cash apply to lease purchases?

No, the incentive applies to leases, not vehicle purchases. It is specifically designed to reduce the cost of leasing through TFS.

6. How long does the 6500 TFS Lease Subvention Cash promotion last?

The promotion is typically available for a limited time, often during special sales events. Check with your local Toyota dealership for current offers.